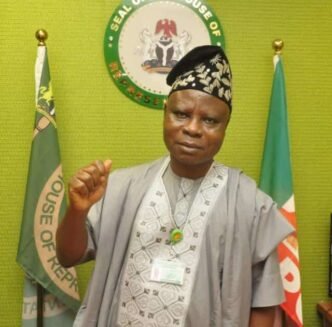

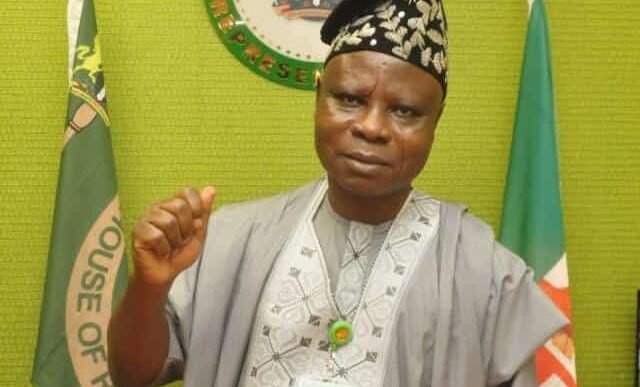

A KEYNOTE SPEECH BY THE RT. HON. ABBAS TAJUDEEN, PhD, GCON, SPEAKER OF THE HOUSE OF REPRESENTATIVES, AT THE OPENING OF THE 11TH ANNUAL CONFERENCE AND GENERAL ASSEMBLY OF THE WEST AFRICA ASSOCIATION OF PUBLIC ACCOUNTS COMMITTEES (WAAPAC), AT THE NATIONAL ASSEMBLY COMPLEX, ABUJA, NIGERIA, ON 8- 12TH SEPTEMBER, 2025

Protocol:

I am deeply honoured to welcome Honourable Colleagues and friends to the 10th House of Representatives at this 11th Annual Conference and General Assembly of the West Africa Association of Public Accounts Committees (WAAPAC), hosted by the Public Accounts Committee of the House of Representatives, with the support of WAAPAC and our international development partners. This gathering could not have come at a more opportune time, as our nations face mounting fiscal pressures that demand stronger legislative oversight of public debt and borrowing.

The theme of this year’s conference, “Strengthening Parliamentary Oversight of Public Debt: The Role of Finance and Public Accounts Committees,” speaks directly to the urgency of safeguarding our financial future. I must, therefore, sincerely thank the Chairman and members of the House Committee on Public Accounts for the outstanding work they have been doing since the inauguration of the 10th House. I would also like to express my appreciation to our development partners for their commitment to accountability and the protection of public finances.

2. Honourable Colleagues and distinguished guests, the theme of this conference goes to the very heart of democratic governance and sustainable development. Indeed, Public debt, when managed prudently, can be a tool for growth and prosperity. Yet, when left unchecked, it becomes a burden that erodes economic stability and threatens the welfare of future generations. Therefore, oversight of public debt is a democratic duty and a moral responsibility of the legislature. Our parliaments must ensure that every borrowing decision reflects prudence, transparency, and the collective interest of our citizens.

3. In Nigeria, as in most of Africa, recent available data indicate that our debt trajectory has reached a critical point. It highlights the urgent need for stronger oversight, transparent borrowing practices, and a collective resolve to ensure that tangible economic and social returns match every naira borrowed.

4. Across Africa, debt levels have reached alarming proportions. By 2022, the continent’s total public debt had reached US$1.8 trillion, with external debt alone surpassing US$1 trillion by 2023. In many cases, governments are spending more on servicing debt than on healthcare and other essential services, shrinking the fiscal space available for development. This continental picture makes clear that Africa faces not just a budgetary concern, but a structural crisis that demands urgent parliamentary attention and coordinated reform. The countries of the West African sub-region carry the same burden.

5. Distinguished Participants, when we examine the sources of Africa’s external financing, it becomes clear that the weight of debt on our continent is shaped by who we borrow from and on what terms. Today, Western private lenders hold about 35 percent of Africa’s government debt through banks, asset managers, and oil traders. Multilateral institutions, such as the World Bank and the IMF, account for another 39 percent, while bilateral loans from other governments comprise 13 percent. Chinese creditors, despite much of the public debate, hold only 12 percent. To place this in sharper focus, in 2019, bondholders alone represented 27 percent of Africa’s external debt, making them the single largest creditor group, ahead of China at 13 percent.

6. The implications of this structure are far-reaching. A significant share of our national revenues is tied to debt servicing rather than being invested in the things our people need most: roads, schools, hospitals, and innovation.

The high cost of commercial loans, coupled with the burden of repayment in foreign currencies, leaves many African economies vulnerable to market shocks. This narrows fiscal space, constrains domestic policy choices, and slows the pace of sustainable development. If Africa is to grow stronger, we must not only negotiate fairer terms of borrowing but also rethink our dependence on external finance. We must channel more energy into mobilising domestic resources, fostering intra-African trade, and creating financial instruments that serve the continent’s own development priorities. Only then can we move from vulnerability to resilience, and from dependency to true economic sovereignty.

7. It is also important to stress that effective oversight of public debt requires vigilance, knowledge, and institutional strength. As already noted, debt levels in Africa are rising at a pace that compels us to act with foresight. By empowering our Public Accounts and Finance Committees, we create institutions that can stand as guardians of fiscal discipline and protect our economies from the risks of reckless borrowing. This conference provides us with an opportunity to reflect, share experiences, and develop new strategies for debt governance that are both responsible and sustainable.

8. Furthermore, the imperative of the subject matter lies in its cross-border nature. No country in our region can claim immunity from the consequences of debt mismanagement. Unsustainable debt in one country can affect the stability of others, weaken regional trade, and undermine collective development. It is therefore our shared responsibility to use WAAPAC as a platform for solidarity, peer learning, and collective action. The resolutions of this assembly will not only shape national policies but will also reinforce the accountability architecture of the entire sub-region.

9. The 10th House of Representatives is firmly committed to transparency and accountability in public finances. We recognize that in Africa, where development challenges remain acute, fiscal responsibility becomes indispensable. This is why the House has taken deliberate steps to strengthen parliamentary oversight mechanisms, improve reporting standards, and ensure that public funds are managed with integrity. In doing so, we reaffirm our conviction that transparency is the cornerstone of good governance and the key to rebuilding public trust.

10. In line with this commitment, I am pleased to announce Nigeria’s readiness to champion the establishment of a West African Parliamentary Debt Oversight Framework under WAAPAC. This framework will harmonize debt reporting across our countries, create regional standards for transparency, and empower our parliaments with timely data for effective scrutiny of borrowing practices. It is my conviction that this framework will strengthen our bargaining power in international finance and protect the long-term interests of our citizens.

11. Beyond frameworks, we must invest in people. Nigeria, working with WAAPAC and development partners, will support the establishment of a capacity-building programme for Public Accounts and Finance Committees across the region. This programme will equip members and staff with modern tools for debt sustainability analysis, fiscal risk assessment, and oversight of complex financial instruments. Our approach to oversight must also be inclusive. In addition to the excellent work the Public Accounts Committee is already doing, the House will further introduce policies that guarantee greater citizen participation in debt governance as part of our Open Parliament policy, which has been sustained since 2023. Major borrowing proposals should be subject to public hearings, and simplified debt reports must be made available to the general public. Oversight is most effective when it is not only parliamentary but also people-driven. Citizens have the right to know, and we have the duty to inform.

13. At the same time, we must ensure that debt oversight is anchored in sustainable development. Borrowing should support infrastructure, health, education, and industries that create jobs and reduce poverty. Reckless debt that fuels consumption or corruption must be exposed and rejected. As representatives of the people, we must never forget that our oversight role is not about figures alone but about the lives and futures behind those figures.

14. This is equally a moment to reaffirm WAAPAC’s growth and relevance. Since its founding in 2009, WAAPAC has stood as a symbol of peer learning and solidarity among parliaments in our region. As we look to the future, we must envision WAAPAC as a continental leader in fiscal accountability, expanding its reach and deepening its impact over the next decade.

15. Distinguished delegates, I wish to once again commend the Chairman and members of the House Committee on Public Accounts for their vision, as well as our development partners and all stakeholders present here for their commitment to fiscal responsibility. Your support and presence testify to the shared resolve to build stronger parliaments and better societies.

16. As we begin this five-day conference, I urge all participants to devote themselves fully to the deliberations. Let us work with dedication, for the communiques and resolutions that will emerge from this gathering hold the potential to strengthen effective public finance management and accountability across our continent and our dear country, Nigeria.

17. It is now my singular honour and privilege to declare the 11th Annual Conference and General Assembly of the West Africa Association of Public Accounts Committees open. Thank you, and God bless the Federal Republic of Nigeria.