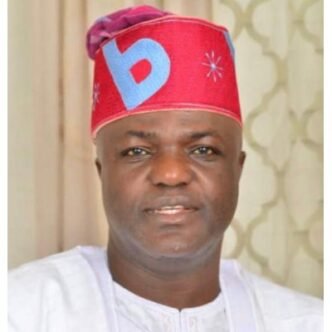

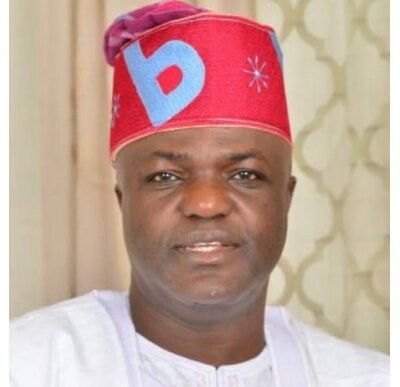

Bill Sponsor: Sen. Kaka, Shehu Lawan. Bill Progress: First Reading

In a recent development within the legislative arena of Nigeria, the Senate has taken a significant step towards enhancing the agricultural sector by presenting the Agricultural Credit Guarantee Scheme Act (Amendment) Bill, 2025, abbreviated as SB. 850. This bill marks the first reading in the legislative process, a crucial phase where its title is introduced without any immediate debate or voting.

The Agricultural Credit Guarantee Scheme was originally established to provide financial support to farmers in Nigeria, ensuring that they can access credit facilities despite the numerous risks associated with agricultural production. These risks often stem from unpredictable weather patterns, market fluctuations, and the inherent uncertainties involved in farming activities. By providing guarantees to financial institutions that lend to farmers, the scheme aims to foster greater investment in the agricultural sector — essential for a nation that relies heavily on agriculture for both food security and economic stability.

The introduction of the Agricultural Credit Guarantee Scheme Act (Amendment) Bill, 2025, signals a proactive approach to addressing ongoing challenges within the agricultural landscape. This amendment is poised to reflect necessary adjustments that align with contemporary agricultural practices and financing needs. It could address critical areas such as expanding the scope of eligible crops, increasing coverage amounts for loans, or streamlining the application process for farmers seeking credit.

During the first reading, the bill was formally presented to the Senate, allowing all members to familiarize themselves with its objectives and implications. At this stage, legislators typically review the bill’s content, raising any preliminary concerns or suggestions for revisions. It is a procedural step that sets the tone for further discussions and eventual debates to take place in subsequent readings. Although the first reading does not involve extensive deliberation, it marks an essential milestone for advocates of agricultural reform and development.

The importance of such legislative efforts cannot be overstated. Nigeria, with its vast agricultural potential, continues to grapple with food insecurity and economic challenges. Access to credit is a perennial issue that hinders many smallholder farmers from maximizing their productivity. By amending the existing framework of the Agricultural Credit Guarantee Scheme, the government demonstrates its commitment to empowering farmers through financial stability.

In recent years, various stakeholders, including farmers’ associations, agricultural advocacy groups, and financial institutions, have voiced their support for reforms that can enhance credit access for rural entrepreneurs. These stakeholders emphasize that improved access to agriculture-related financing is vital to stimulating economic growth, reducing unemployment, and ensuring a robust food supply chain. The successful passage of SB. 850 could pave the way for increased investments in agriculture, which is crucial for a nation that relies on this sector for the livelihoods of millions of its citizens.

Moreover, analyzing the potential impacts of the Agricultural Credit Guarantee Scheme Act (Amendment) Bill reveals significant opportunities for modernization. As global agricultural practices evolve with technology, there is a pressing need for Nigeria’s agricultural credit scheme to adapt accordingly. Incorporating elements such as digital financing solutions, micro-loans, and capacity-building initiatives could be pivotal in solidifying the agricultural sector’s resilience and sustainability.

Looking beyond the immediate benefits to farmers, a successful amendment of this bill could attract international investments into Nigeria’s agricultural market. Investors are likely to evaluate the stability of credit systems and the legislative environment before committing resources. Therefore, showing a responsive legislative framework through bills like SB. 850 can enhance investor confidence and foster partnerships that could leverage both local and international resources for agricultural development.

From an economic perspective, enhancing agricultural financing contributes to broader goals of national development. By ensuring that farmers have access to essential capital, the country can work towards achieving self-sufficiency in food production, reducing reliance on imports, and potentially transforming agricultural exports into a significant source of revenue.

As the legislative process advances, the discussion surrounding SB. 850 will likely spark debate among members of the Senate, agricultural experts, and civil society. This engagement is critical as it ensures multiple perspectives are considered, particularly those of the farmers who will ultimately be affected by this legislation. Stakeholder input could influence amendments that ensure the bill resonates with the realities of agricultural practices in Nigeria.

In conclusion, the first reading of the Agricultural Credit Guarantee Scheme Act (Amendment) Bill, 2025 represents not just a procedural formality, but a beacon of hope for Nigeria’s agricultural sector. As it navigates through the legislative waters, the bill holds the potential to transform the landscape of agricultural financing, support food security, stimulate the economy, and ultimately uplift the millions of Nigerians dependent on agriculture. The ongoing discussions and eventual outcomes of this bill will be closely monitored by various stakeholders, as they embody the promise of a more resilient and prosperous agricultural future for Nigeria.