The Senate Committee on Appropriations conducted a high-stakes, five-hour interactive session on Thursday, questioning the Federal Government’s economic team regarding the ₦58.472 trillion 2026 Appropriation Bill. The hearing focused on the sustainability of Nigeria’s debt, the realism of revenue benchmarks, and the status of capital project funding.

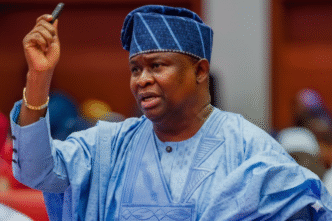

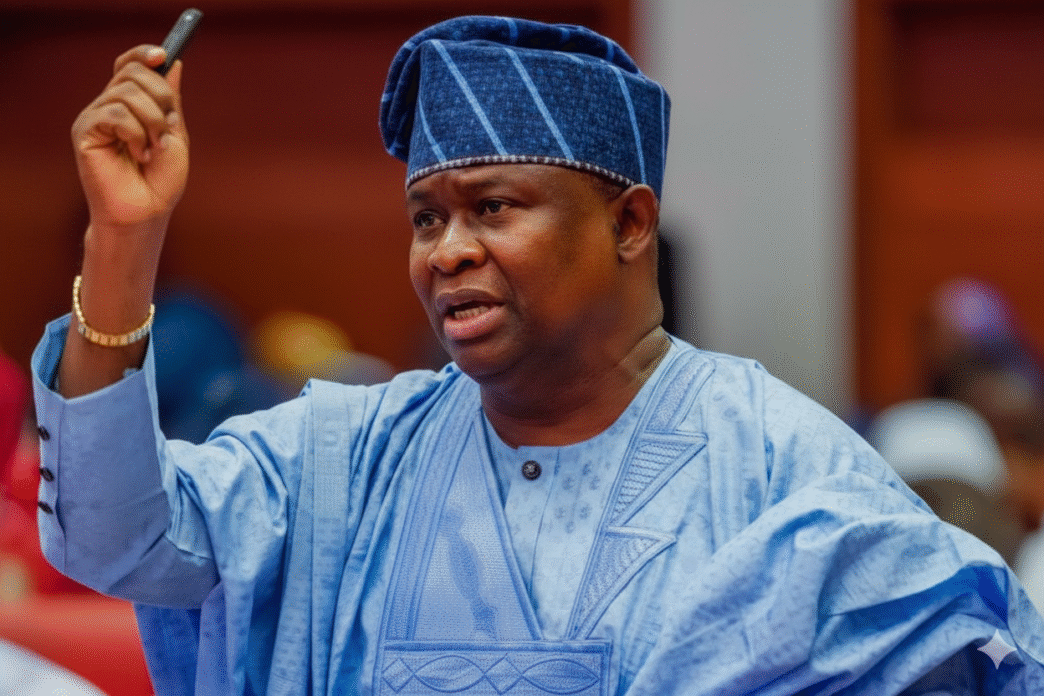

The session, chaired by Senator Solomon Olamilekan Adeola (Ogun West), highlighted legislative concerns over a “wide gap” between projected and actual oil revenues. Lawmakers pressed for clarity on how the government intended to fund the ambitious budget amidst a national debt profile estimated at ₦152 trillion.

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, defended the administration’s fiscal strategy, describing the oil production benchmark of 1.84 million barrels per day as a “stretch target” designed to incentivize higher output.

“It is a stretch target so that the authorities do not settle for lower output,” Edun explained, adding that the administration remains within “safe limits” as long as spending is disciplined. He further emphasized that security remains the government’s top priority, confirming that emergency funding and critical foreign payments for security equipment have been expedited recently.

Addressing the national debt, Edun argued that the primary challenge is not the debt-to-GDP ratio, but rather the high cost of international borrowing for developing nations. He noted that Nigeria is currently leading discussions on debt sustainability and rising interest rates through its chairmanship of the G24 technical group.

Zacch Adedeji, Executive Chairman of the Nigeria Revenue Service (NRS), cautioned against inflated revenue expectations. He reminded the committee that under the Petroleum Industry Act (PIA), government earnings from oil are restricted to taxes and royalties, as the NNPCL now operates as a limited liability company.

“Budget efficiency is not in the quantum of the budget; it is in what you can carry out,” Adedeji stated, noting that high production costs directly impact the net revenue available to the government.

In response to concerns regarding the slow implementation of previous budgets, the Minister of State for Finance, Dr. Doris Uzoka-Anite, provided a timeline for outstanding payments. She assured the committee that:

Payments for outstanding 2024 capital projects commenced this week.

The financial management system is fully operational.

2025 budget funding is beginning, with MDAs required to upload cash plans by Monday to facilitate payments.

All outstanding capital components for 2024 and 2025 are expected to be processed by March 31, 2026.

Senator Adeola questioned the feasibility of the budget size, suggesting that the disposal of certain assets could be a viable path to reducing the overall debt stock and future borrowing costs. “The question is: Do we reduce the ₦58.472 trillion 2026 budget, or do we proceed and make adjustments?” he queried.

The session, which included the Minister of Budget and Economic Planning, Senator Atiku Bagudu, and the Accountant-General of the Federation, Shamsedeen Babatunde Ogunjimi, moved into a closed-door meeting before adjourning.