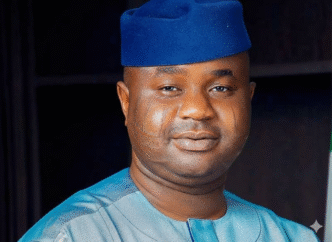

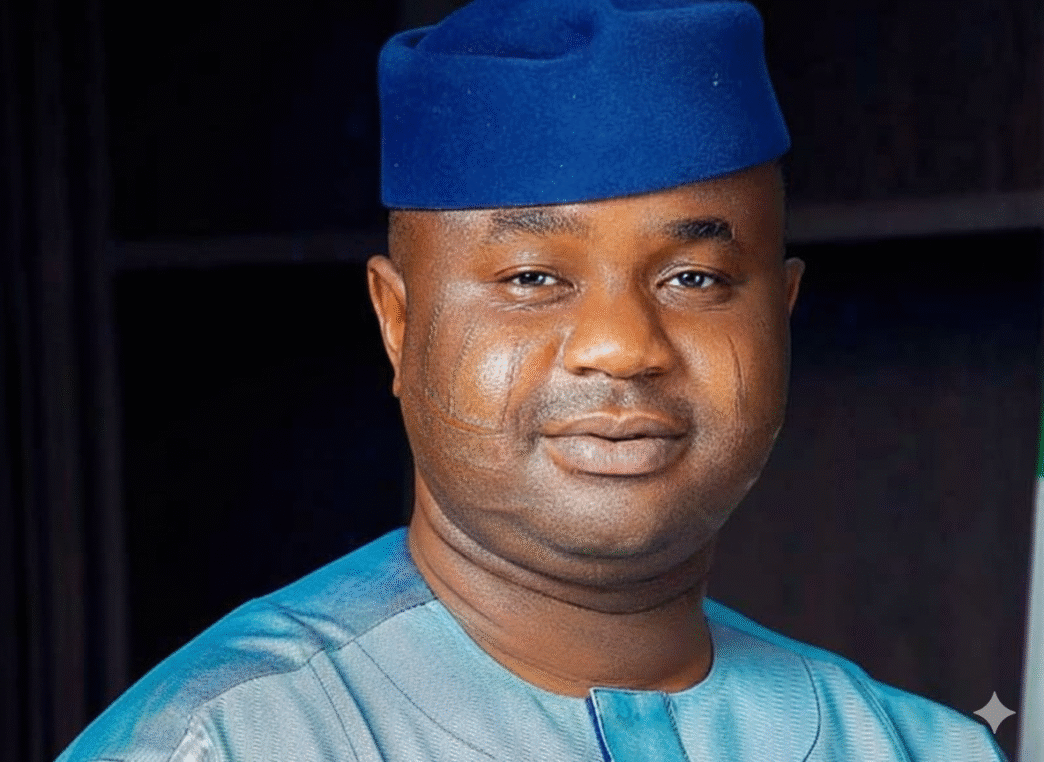

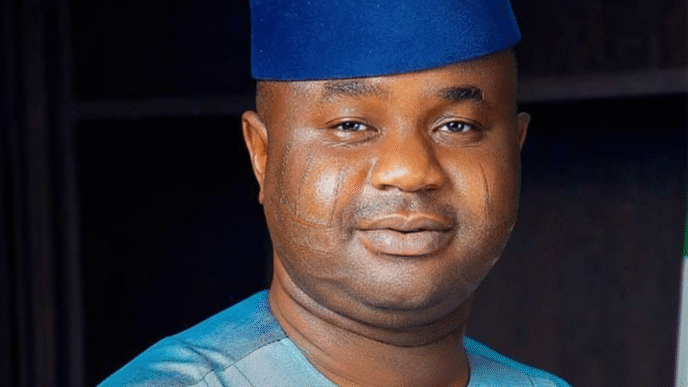

Dr. Zacch Adedeji, Executive Chairman of the Nigeria Revenue Service (NRS), formerly the Federal Inland Revenue Service (FIRS), has reaffirmed that the Federal Government’s 2025 tax reforms are designed to foster economic fairness and simplify the tax landscape rather than increase the financial weight on citizens and businesses.

Speaking during a recent engagement, Dr. Adedeji clarified that the four landmark tax bills signed into law by President Bola Ahmed Tinubu are part of a strategic “fiscal modernization agenda.” He emphasized that the primary goal is to “tax right, not tax more,” shifting the focus from taxing investments and capital to taxing profits and consumption.

Key Highlights of the 2025 Reforms:

Relief for Low-Income Earners: The reforms exempt individuals earning below ₦800,000 annually from Personal Income Tax, effectively boosting the purchasing power of minimum wage earners and vulnerable households.

Support for Small Businesses: The exemption threshold for small companies has been doubled from ₦25 million to ₦50 million in annual turnover. Additionally, these businesses are now exempt from Companies Income Tax (CIT) and withholding tax deductions.

Reduction in Corporate Tax Rates: To stimulate industrial growth, Company Income Tax is scheduled to drop from 30% to 25% by 2026, making Nigeria a more competitive destination for investment.

Essential Exemptions: To cushion the cost of living, Value Added Tax (VAT) will no longer apply to essential goods and services, including food, healthcare, education, and housing.

Institutional Transformation: The transition of the FIRS into the Nigeria Revenue Service (NRS) creates a unified, technology-driven authority. This “One-Stop-Shop” approach eliminates multiple taxations and streamlines compliance through digital tools like the National e-Invoicing system and the *829# USSD service.

“These reforms are about building a social contract rooted in transparency and accountability,” Dr. Adedeji stated. “By modernizing our tax administration and automating processes, we are closing loopholes for evasion while ensuring that the law is applied fairly to all. We are not interested in aggressive revenue drives that stifle business; we want to help companies grow so that the nation can prosper.”

The NRS Chairman also debunked concerns regarding the potential weaponization of tax enforcement, noting that the new laws minimize administrative discretion and rely on objective, rule-based systems. He assured the public that the six-month transition period leading up to full implementation on January 1, 2026, is dedicated to stakeholder education and alignment with the fiscal calendar.

The Nigeria Revenue Service remains committed to its core mandate: simplifying the tax process, maximizing revenue for national development, and fostering an environment where every Nigerian can thrive.