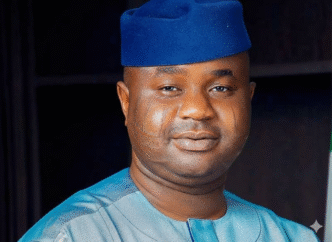

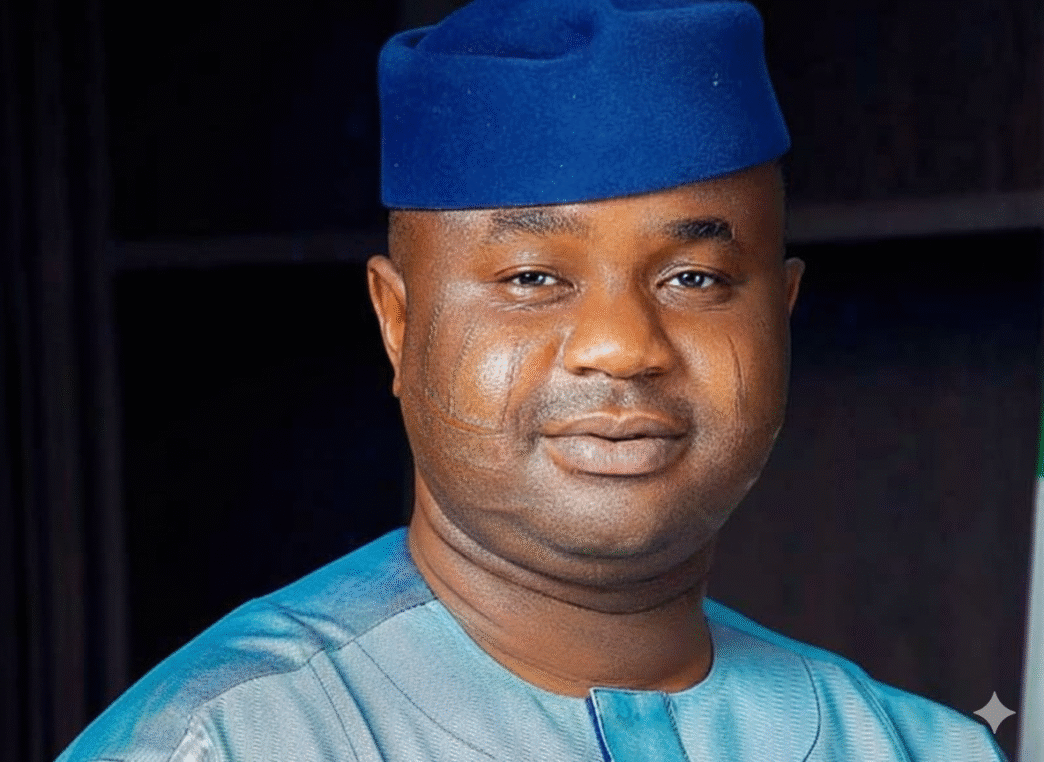

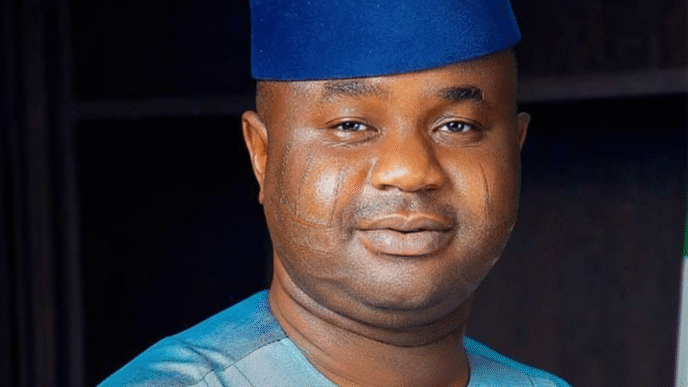

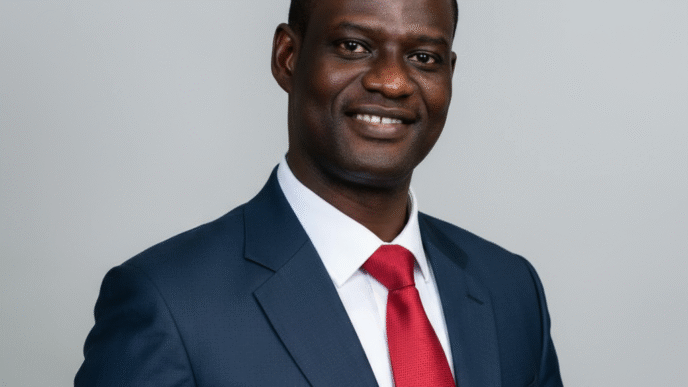

Dr. Zacch Adedeji, Executive Chairman of the Nigeria Revenue Service (NRS), has moved to quell public concerns regarding the 2025 tax reforms, categorically stating that the new laws contain no provisions that impose a burden on the poor.

Speaking during a high level engagement on Wednesday, Dr. Adedeji emphasized that the administration’s “fiscal surgery” is strategically designed to protect vulnerable Nigerians while streamlining the nation’s revenue collection system. He clarified that essential services and goods including food, public transportation, and healthcare are explicitly exempted from taxation under the new framework.

The NRS Chairman addressed circulating misconceptions by highlighting the deliberate “pro-poor” architecture of the reforms. He noted that the primary objective is to shift the tax focus toward high-earning entities and consumption by the wealthy, rather than the daily survival of the masses.

“I want to be very clear: there is no provision in the law that taxes the poor,” Dr. Adedeji stated. “We have ensured that livelihood necessities such as, food, education, healthcare, and transport remain tax-free. Our goal is to tax the fruit, not the seed; to tax prosperity, not poverty.”

Key Pro-Poor Protections in the New Laws:

Zero Tax on Essentials: Value Added Tax (VAT) will not be applied to basic food items, medical products, educational materials, or public transport fares.

Threshold for Low-Income Earners: The reforms maintain significant exemptions for individuals earning below the national minimum wage threshold, ensuring that the lowest earners retain 100% of their take-home pay.

Small Business Relief: Businesses with an annual turnover of less than ₦50 million are exempted from Companies Income Tax (CIT) and withholding taxes, allowing micro and small enterprises to reinvest their earnings.

Eliminating Hidden Levies: By harmonizing over 60 different taxes into a single-digit number of levies, the government is removing the “nuisance taxes” that often disproportionately affect petty traders and transporters.

Dr. Adedeji further explained that the transition from the Federal Inland Revenue Service (FIRS) to the Nigeria Revenue Service (NRS) is more than a name change; it represents a shift toward a more compassionate and efficient tax administration.

“The fear being expressed by many is the result of a trust deficit from the past,” Adedeji acknowledged. “However, the 2025 laws are written to be transparent and objective. We are automating the system so that there is no room for harassment. If you are a low-income earner or a small business owner, the law is on your side.”

The NRS remains committed to its mission of generating the revenue necessary for national development without stifling the economic growth of everyday Nigerians.