The Executive Secretary of the National Assembly Library Trust Fund (NALTF), Rt. Hon. Henry Nwawuba, warmly received a delegation from the Society of Women in Taxation (SWIT), led by its National Chairperson, Dr. Caroline Ndubuisi, FCTI. This meeting set the stage for a potential partnership that is anticipated to lay the groundwork for informed fiscal policy-making.

SWIT, founded on May 7, 2010, serves as a vital arm of the Chartered Institute of Taxation of Nigeria (CITN). It provides a dedicated platform for women in the taxation field, focusing on their professional development, advocacy, and voice within tax policy discussions. The organization is committed to promoting socio-economic development, particularly through the lens of gender inclusion in tax administration. This commitment is particularly relevant today as the economic landscape evolves and the importance of diverse representation in policy-making becomes clearer.

One of the central themes discussed during the meeting was the advancement of gender inclusion. SWIT’s focus on promoting gender diversity and fostering a robust representation of women in taxation resonates with NALTF’s broader goal of supporting informed legislation. By working together, both organizations can significantly contribute to inclusive policymaking that reflects the needs and perspectives of a diverse population, such as the development of gender-responsive tax frameworks.

The potential partnership between NALTF and SWIT comes at a pivotal time when the importance of gender equity and inclusive governance is being recognized globally. Women’s representation and participation in decision-making processes, particularly in taxation and fiscal policies, have far-reaching implications for economic growth and social development.

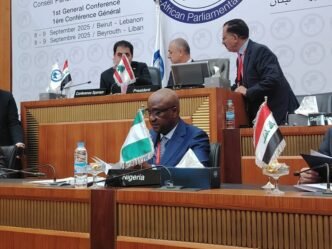

View more photos from the engagement below: