The Nigeria Revenue Service (NRS) has issued a formal clarification regarding the tax implications of the recent significant share sell-down by MTN Nigeria. The move comes as part of a broader effort to ensure transparency and provide certainty for investors within the Nigerian capital market following the implementation of the new Tax Laws.

The transaction, which has drawn significant attention from market analysts and the investing public, serves as a landmark case for the application of Capital Gains Tax (CGT) and other relevant fiscal provisions under the current administration’s reformed tax framework.

The NRS emphasizes that the tax treatment of large-scale equity divestments is governed by the principles of fairness and the promotion of a competitive investment climate. The clarification aims to address questions regarding the 10% Capital Gains Tax on the disposal of shares, particularly where the value exceeds the statutory thresholds.

Key highlights of the clarification include:

CGT Application: Reaffirming the specific conditions under which Capital Gains Tax applies to the disposal of shares in Nigerian companies to ensure revenue optimization without stifling market liquidity.

Investor Protections: Highlighting the available incentives for reinvestment and the mechanisms in place to prevent double taxation on investment returns.

Regulatory Synergy: The NRS is working closely with the Securities and Exchange Commission (SEC) and the Nigerian Exchange Group (NGX) to ensure that tax filings related to such high-profile transactions are processed with speed and accuracy.

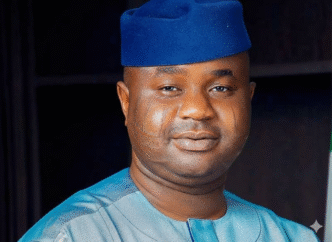

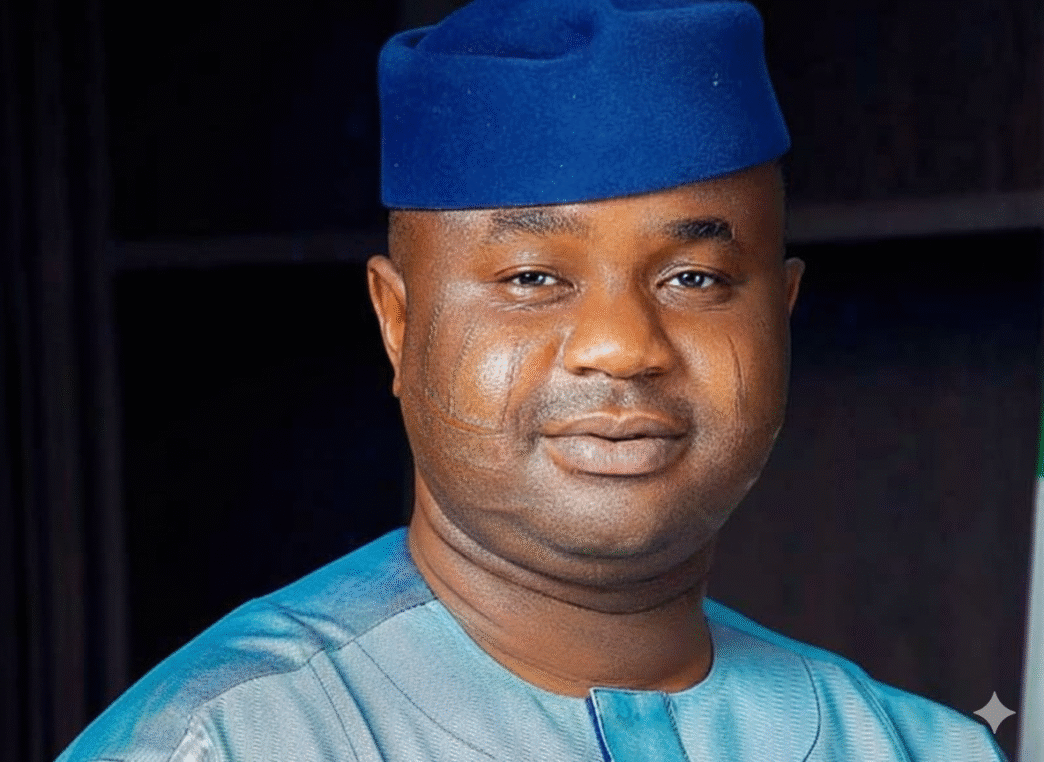

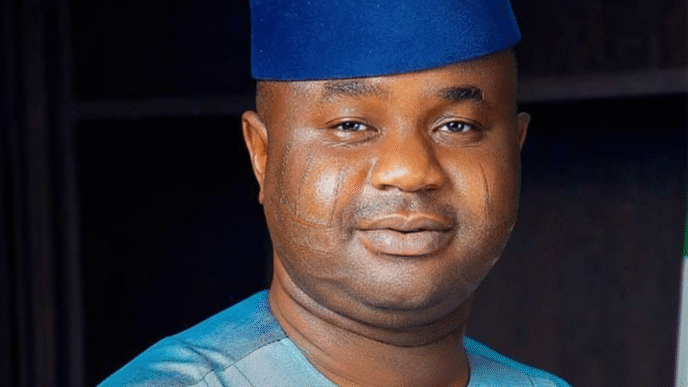

A Pro-Growth Fiscal Environment Commenting on the development, the Executive Chairman of the National Revenue Service, Dr. Zacch Adedeji, stated that the goal of the tax authority is to act as a partner in progress with corporate entities.

“The recent activity surrounding MTN Nigeria’s shares demonstrates the vibrancy of our capital markets,” Dr. Adedeji said. “Our role is to provide a clear, predictable fiscal roadmap. By clarifying the tax obligations for such significant transactions, we are reinforcing Nigeria’s position as a transparent and attractive destination for both local and foreign institutional capital.”

The NRS remains committed to engaging with blue-chip companies and institutional investors to simplify compliance requirements. This proactive engagement is intended to minimize disputes and ensure that the transition to the new tax regime supports the Federal Government’s objective of long-term economic stability.