As the Federal Government’s ambitious fiscal reforms gain momentum, the Nigeria Revenue Service (NRS) has reiterated its commitment to a “precision-based” implementation strategy. This approach aims to ensure that the ongoing transformation of Nigeria’s tax landscape translates into sustainable economic stability rather than administrative complexity.

Following recent public discourse and expert analysis regarding the scale of the 2025 Tax Reforms, the NRS is emphasizing that while the government’s vision is bold, the execution will be characterized by technical accuracy, stakeholder collaboration, and data-driven policy adjustment.

Transitioning from Ambition to Impact, The current “tax revolution” represents the most significant overhaul of Nigeria’s fiscal policy in decades. However, the NRS acknowledges that the success of these reforms depends on more than just ambitious revenue targets; it requires the precise application of law to foster a business-friendly environment.

Key pillars of the NRS “Precision Strategy” include:

Targeted Enforcement: Utilizing advanced data analytics to identify high-net-worth tax gaps while protecting small businesses and low-income earners.

Clarity of Interpretation: Providing continuous technical circulars to eliminate ambiguity in the new laws, ensuring that taxpayers and practitioners have a clear roadmap for compliance.

Feedback Integration: Actively engaging with organized private sector groups, professional bodies, and civil society to refine implementation processes in real-time.

Operational Efficiency: Reducing the “cost of collection” through the full digitalization of tax administration, making it easier for citizens to fulfill their obligations without friction.

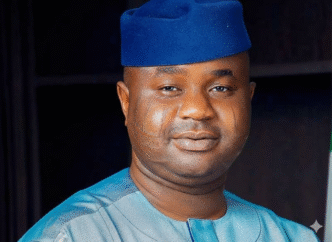

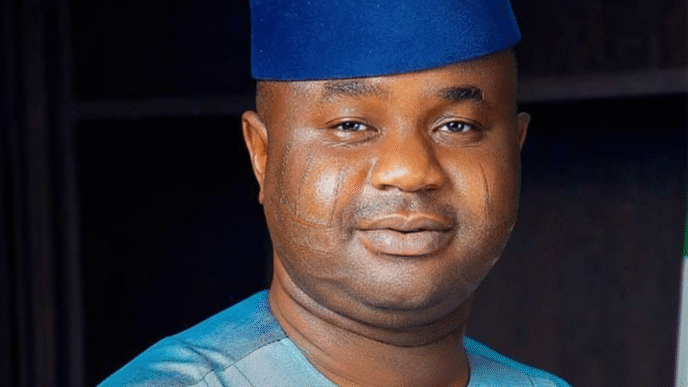

The Executive Chairman of the NRS, Dr. Zacch Adedeji, noted that the reform journey is a marathon that requires meticulous attention to detail.

“Our vision for a tax-compliant Nigeria is indeed ambitious, but our methods must be precise,” Dr. Adedeji stated. “We are moving away from a regime of guesswork toward a system of certainty. Every regulation we implement is designed to strike a delicate balance: generating the revenue necessary for national development while ensuring we do not stifle the very businesses that power our economy.”

Building Public Trust, The NRS recognizes that transparency is the bedrock of voluntary compliance. By prioritizing precision over mere expansion, the Service aims to build a culture of trust where every Nigerian understands that tax revenues are being managed with the highest level of professional integrity.

As the “Tax Revolution” enters its next phase, the NRS remains dedicated to listening to the concerns of the public and adjusting its sails to ensure the ultimate goal of a prosperous, self-sufficient Nigeria is achieved.