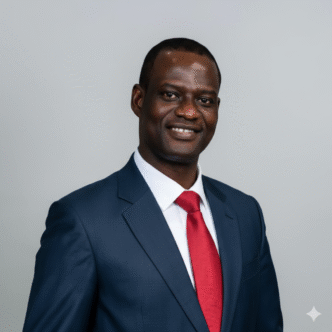

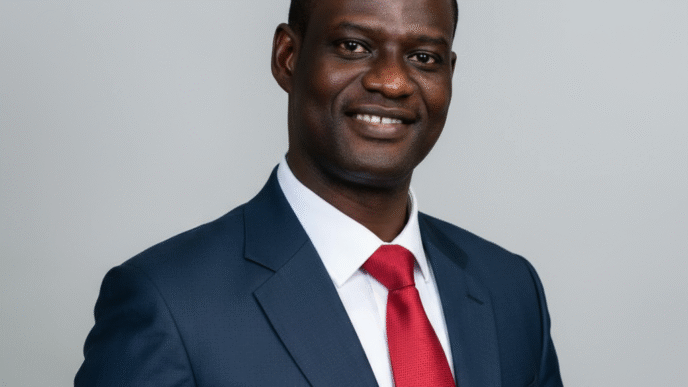

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has declared that Nigeria’s current personal income tax structure is “unjust and unsustainable,” revealing that a staggering 96% of the country’s personal income tax revenue is currently generated from low-income earners.

Speaking on the imperative of the 2026 Tax Reform Law, Oyedele characterized the existing system as the “taxation of poverty,” noting that the burden of funding the state has fallen disproportionately on those least able to afford it, while many high-net-worth individuals remain outside the tax net.

To rectify these long-standing distortions, the 2026 tax framework introduces sweeping exemptions designed to protect the vulnerable and stimulate household growth.

Key highlights of the reform include:

- Full Exemption for Minimum Wage Earners: Individuals earning the national minimum wage will be completely exempt from personal income tax.

- Increased Tax Thresholds: Through a combination of revised tax bands and allowable deductions, individuals earning up to approximately ₦1.2 million gross annually will effectively pay zero tax.

- Relief for Small Businesses: Enterprises with an annual turnover of less than ₦100 million will be exempt from Corporate Income Tax (CIT) and Value Added Tax (VAT), providing a critical lifeline for SMEs.

- Targeting Wealthy Earners: The reform shifts the focus to the top 2% of earners and large institutional investors, ensuring that those with a higher capacity to pay bear a fairer share of the national tax burden.

Comparing Nigeria’s current revenue to other African peers, Oyedele noted that South Africa generates over ₦60 trillion equivalent from personal income tax, 60% of which is paid by the top 1.5% of earners while Nigeria struggles to collect ₦2 trillion despite having a significantly larger population.

“We are moving from economic volatility to a phase of stability and growth,” Oyedele stated. “The 2026 tax reform is a key driver of this transition. If the government was collecting more tax from you before and the new law reduces that burden, there is no reason to fear the change.”

The Committee urged Nigerians to disregard “noise” and misinformation regarding the new laws. Oyedele reassured the public that the reforms are not intended to increase the cost of living but rather to increase disposable income for households and reduce the prices of basic consumption through VAT exemptions on essential goods.

The 2026 Tax Reform Law is the result of 18 months of intensive stakeholder engagement involving over 800 groups, including state governments, civil society, and the private sector. It represents the most comprehensive effort in Nigeria’s history to create a fair, transparent, and technology driven tax system.