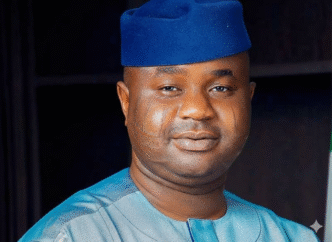

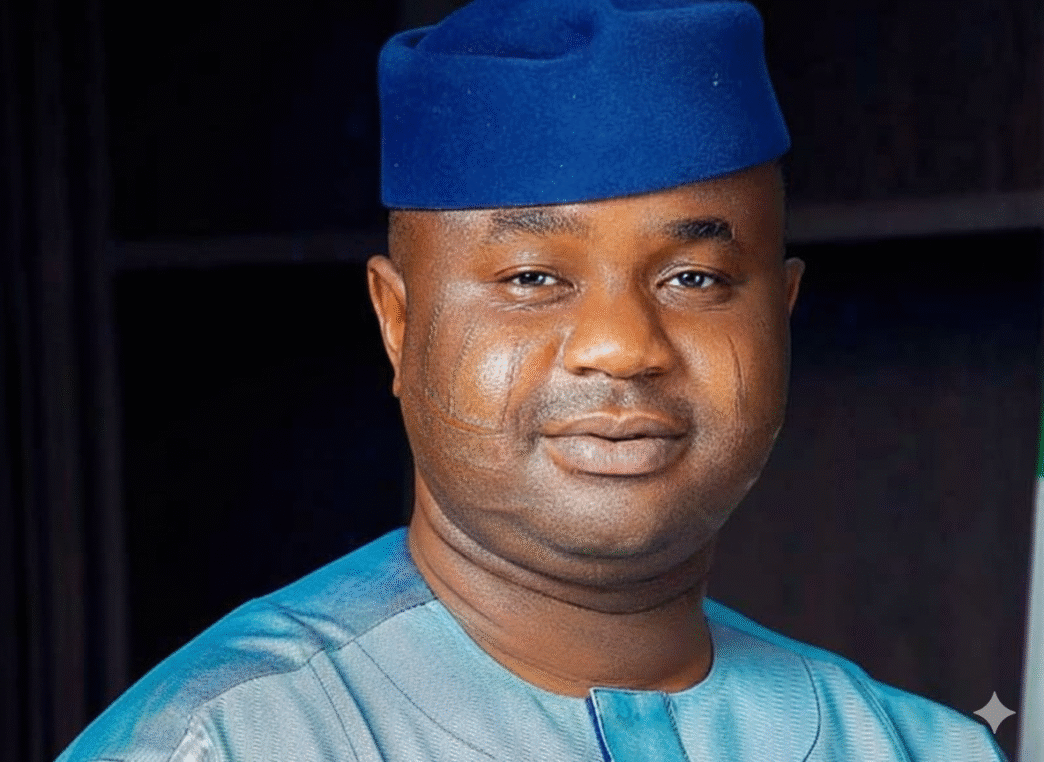

The Executive Chairman of the Nigeria Revenue Service (NRS), Dr. Zacch Adedeji, has issued a definitive clarification regarding the 2025 tax reform bills, assuring Nigerians that the new laws do not include provisions to tax bank deposits, personal savings, or private assets.

Speaking during a sensitization engagement in Abuja, Dr. Adedeji addressed rising public anxiety fueled by misconceptions about the scope of the “fiscal modernization agenda.” He emphasized that the reforms are aimed at institutionalizing a fair tax regime and do not target the accumulated wealth or savings of individuals.

Dr. Adedeji categorically debunked rumors suggesting that the government intends to dip into the private bank accounts of citizens through new levies. He maintained that the sanctity of personal savings remains protected under the new legal framework.

“There is absolutely no provision in the four bills currently before the National Assembly that seeks to tax bank deposits or personal assets,” the NRS Chairman stated. “Our objective is to tax economic activity and gains, not the capital or savings that individuals have worked hard to build. We are here to encourage financial inclusion, not to create fear that would drive people away from the banking system.”

Key Clarifications on the 2025 Tax Laws:

- Bank Deposits are Safe: No new taxes or levies will be applied to the balance in personal or corporate bank accounts.

- Focus on Consumption and Profit: The reforms transition the system toward taxing consumption (VAT) and realized profits (CIT), rather than investment or personal capital.

- National e-Invoicing for Businesses: The introduction of technology like e-invoicing is designed to track commercial transactions for VAT purposes, not to monitor private financial holdings.

- No “Asset Grab”: Personal assets such as homes, vehicles, and other private property are not subject to the new tax provisions.

Modernizing for Growth, Not Hardship The Chairman explained that the transition from the Federal Inland Revenue Service (FIRS) to the Nigeria Revenue Service (NRS) is designed to create a customer-centric agency that relies on data and transparency. By automating tax collection, the government intends to close loopholes used by tax evaders while ensuring that law-abiding citizens are not harassed.

“We are performing a ‘surgery’ on the system to remove the tumors of multiple taxation and inefficiency,” Adedeji added. “The goal of President Bola Ahmed Tinubu is to create a predictable and simplified environment where businesses can thrive. When businesses thrive and people are gainfully employed, the economy grows and that is where our revenue comes from, not from taxing people’s savings.”

The NRS continues to urge the public to seek information from official channels and ignore the “misleading narratives” intended to cause panic. The agency remains committed to a transition process that prioritizes communication and stakeholder feedback.