The Federal Government has announced a strategic pause in the issuance of implementation guidelines for the 2026 Tax Reform Law. The decision aims to resolve emerging uncertainties regarding the final gazetted versions of the legislation and ensure that the instructions provided to the public are perfectly aligned with the law as passed by the National Assembly.

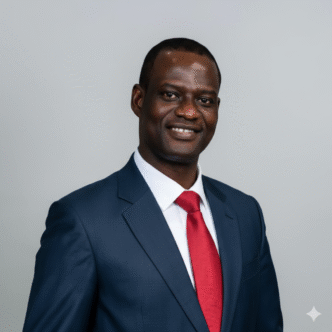

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, disclosed that while the reform remains on course, it is critical to address discrepancies identified between the harmonized bills signed by the President and the versions currently in circulation.

The delay is a proactive measure to prevent confusion among businesses and individual taxpayers. By synchronizing the guidelines with the definitive legal text, the government aims to provide a stable and predictable fiscal environment.

“Our goal is to ensure that when these guidelines are released, they are beyond reproach and provide absolute clarity,” Oyedele stated. “We are working closely with the National Assembly and the Office of the Attorney General to verify every clause. It is better to wait a few days for a perfect document than to rush out guidelines based on uncertain text.”

The pause follows reports of “clerical errors” and “unintended alterations” in the gazetted copies of the four tax reform bills. The Committee is currently collaborating with the Clerk to the National Assembly to ensure that the re-gazetted versions accurately reflect the legislative intent of the lawmakers.

Key areas being reviewed include:

Sectional Referencing: Ensuring all internal cross-references within the Acts are accurate.

Definitions: Clarifying technical terms to prevent multiple interpretations.

Effective Dates: Confirming the commencement timeline for specific provisions to avoid administrative overlaps.

Commitment to the 2026 Timeline: Despite the delay in issuing guidelines, the Federal Government maintains that the core of the tax reforms including the exemption of low-income earners and relief for small businesses remains the priority. The Committee reassured stakeholders that the administrative machinery of the Nigeria Revenue Service (NRS) is being prepared to implement the final version of the law seamlessly.

“This is a technical pause, not a policy reversal,” Oyedele added. “The commitment to reducing the tax burden on 98% of Nigerian workers and 97% of small businesses is sacrosanct. We are simply ensuring the legal foundation is airtight.”

The Presidential Committee expects the verification process to be concluded shortly, after which a comprehensive set of explanatory notes and implementation guidelines will be made available to the public. Taxpayers are advised to continue using existing frameworks until the official 2026 guidelines are formally published.