Tuesday, January 13, 2026 | The National Assembly Library hosted a policy dialogue on the nation’s newly enacted tax laws to bridge the information gap regarding Nigeria’s significant fiscal overhaul. The session, aimed at providing clarity and addressing public misconceptions, featured technical insights from the Nigeria Revenue Service (NRS)—formerly known as the Federal Inland Revenue Service (FIRS)—following the implementation of the 2025 Tax Reform Acts which took full effect on January 1, 2026.

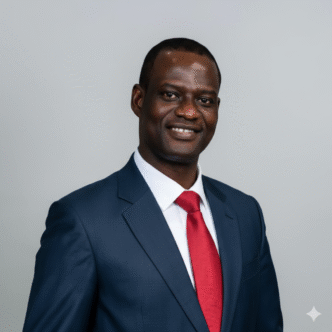

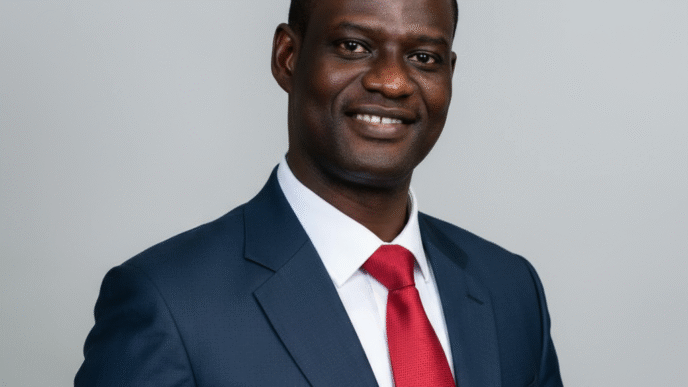

The dialogue was anchored by Bright Igbinosa, an accomplished tax expert and Head of the Tax Reform Analysis Unit in the Fiscal and Tax Reforms Implementation Division of the NRS. In a detailed presentation, Igbinosa debunked several prevailing myths regarding the new tax regime, emphasizing that the reforms are designed to stimulate economic growth rather than impose a burden on small businesses.

“The core philosophy of these reforms is ‘simplifying tax, maximizing revenue,'” Igbinosa stated. “By consolidating multiple levies into a unified system, we are creating a predictable environment that encourages investment and protects the most vulnerable earners in our society.”

A Vision for Evidence-Based Policy

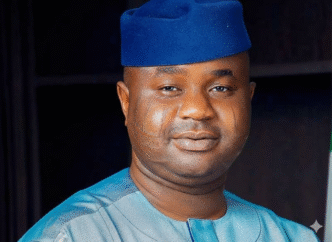

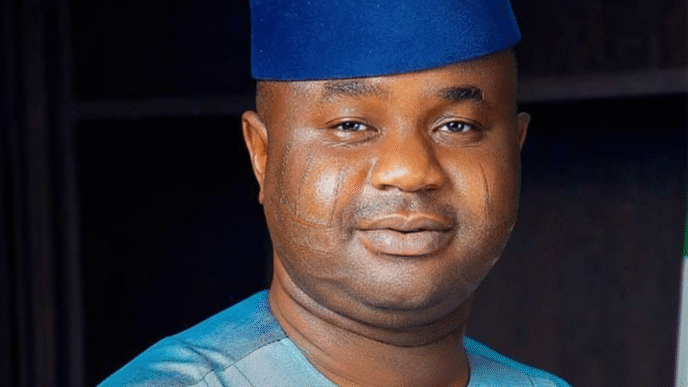

The Executive Secretary of the National Assembly Library, Rt. Hon. Henry Nwawuba, formally welcomed the NRS delegation. He reiterated the Library’s commitment to serving as a non-partisan platform where complex national issues can be examined with academic and legal depth.

Nwawuba noted that as the custodian of Nigeria’s legislative history, the Library plays a critical role in ensuring that both lawmakers and the public understand the intent and mechanics of the laws that govern the economy.

Summary of the New Tax Laws

The 2025 Tax Reform package comprises four primary statutes that collectively modernize the Nigerian fiscal landscape.

- Nigeria Tax Act (NTA) – Consolidates and simplifies the fiscal framework. Repeals and replaces major acts (CIT, PIT, VAT, CGT). Exempts companies with < ₦100m turnover from income tax.

- Nigeria Tax Administration Act (NTAA) – Standardizes procedures for tax assessment and collection. Mandates the Electronic Fiscal System (EFS) for digital filing. Introduces mandatory Tax Identification Numbers (TIN) for all entities.

- Nigeria Revenue Service (Establishment) Act – Modernizes the federal revenue authority. Formally transitions the FIRS into the NRS, granting it expanded powers to assess and account for federal revenue.

- Joint Revenue Board (Establishment) Act – Harmonizes taxes across federal, state, and local levels. Establishes the Joint Revenue Board and the Office of the Tax Ombuds to coordinate revenue collection and resolve disputes.

A major highlight of the dialogue was the clarification of the Development Levy, which replaces the Tertiary Education Tax and other sectoral levies. Igbinosa explained that this consolidation reduces the administrative burden on companies, allowing them to interface with a single agency rather than multiple government bodies.

Furthermore, the dialogue highlighted the Personal Income Tax (PIT) changes, which now exempt individuals earning ₦800,000 or less per annum, providing significant relief for low-income earners amidst current economic realities.

View more photos from the engagement below: