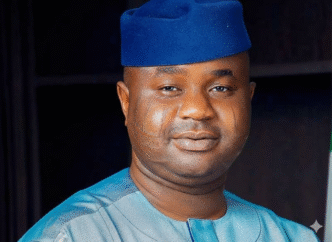

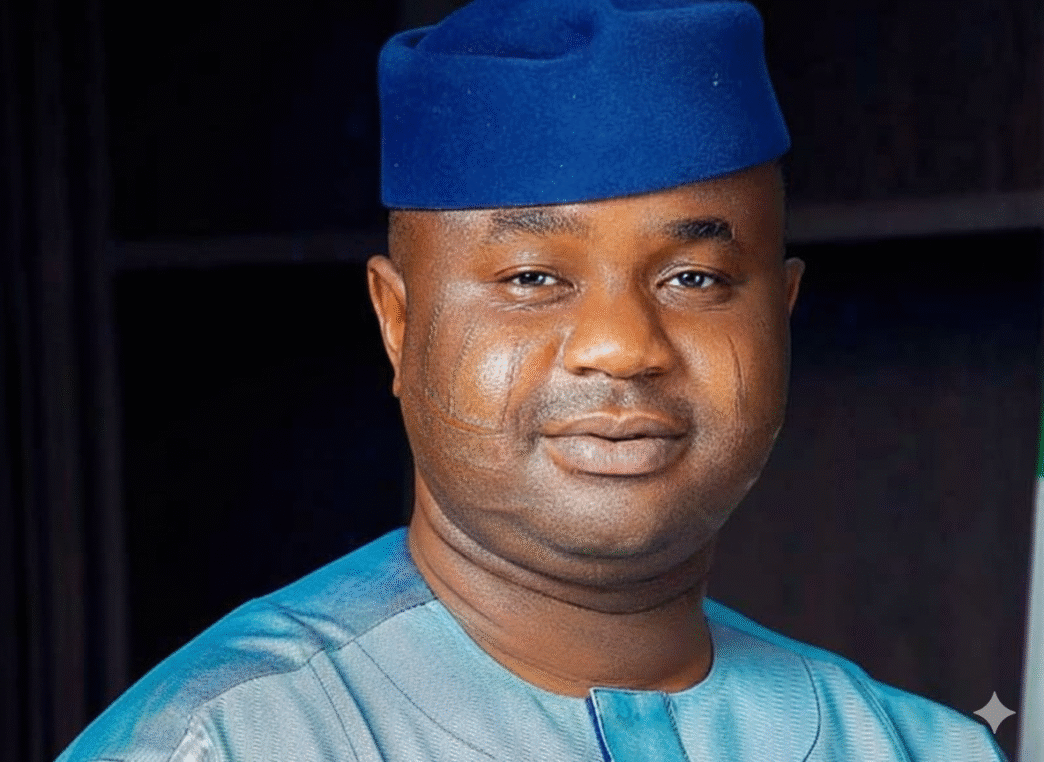

The Chairman of the Nigeria Revenue Service (NRS), Dr. Zacch Adedeji, has doused controversies surrounding the new tax reforms, affirming that the agency is strictly implementing the laws as gazetted and following due process.

In a recent interview, Dr. Adedeji clarified that the NRS’s mandate begins and ends with the implementation of the law as transmitted and published in the official government gazette. He addressed recent debates regarding discrepancies between the gazetted version and the National Assembly’s “harmonized version,” describing such matters as internal legislative procedures.

Key Clarifications on the New Tax Regime

The Gazetted Version is Final: Dr. Adedeji emphasized that once a law is gazetted within the legal timeframe, it becomes the binding legal document. “If something has no place in the law, then it does not exist legally,” he stated, adding that the executive has not altered any approved texts.

Effective Date: Contrary to public speculation, the laws became operational on June 29, 2025, following President Bola Tinubu’s assent. The January 1, 2026, date simply marked the end of a six-month transition period allowed for taxpayers and businesses to adjust to new rates and systems.

Protecting the Poor: The Chairman reiterated that 95% of low-income Nigerians are exempt from taxes under this reform. By removing VAT on basic food items and essential transport, the reform directly targets the 90% of disposable income that poor households spend on necessities.

Banking and Privacy: Dr. Adedeji dispelled rumors of arbitrary bank account prying. He clarified that reporting thresholds N25 million for individuals and N100 million for companies have long existed as part of global data management standards and are not new inventions of the current reform.

A Pro-Growth Philosophy Echoing President Tinubu’s “tax the fruit, not the seed” mantra, the NRS Chairman highlighted that the reform replaces turnover-based minimum taxes with profit-based assessments. This ensures that companies are not penalized for making losses, thereby protecting capital and encouraging reinvestment.

“Our objective is not enforcement for its own sake, but to help people prosper,” Adedeji remarked. “The operational guidelines are ready, and we are focused on delivering the long-term benefits of this reform to all Nigerians.”

The NRS continues to urge the public and the business community to rely on official guidelines as the full implementation of the tax laws moves forward to stimulate national economic growth.