Following the official commencement of Nigeria’s landmark 2026 tax reforms, industry experts and stakeholders are highlighting a transformative shift for the nation’s manufacturing sector. The new legislative framework, designed to simplify the tax landscape and incentivize production, offers a suite of strategic benefits aimed at reducing operational costs and boosting global competitiveness for local manufacturers.

The reforms comprising the Nigeria Tax Act (NTA), the Nigeria Tax Administration Act (NTAA), the Nigeria Revenue Service Act (NRSA), and the Joint Revenue Board Act (JRBA) mark the most significant overhaul of the nation’s fiscal policy in decades.

Key Benefits for Manufacturers Include:

Enhanced Value Added Tax (VAT) Recovery: In a major win for the industry, the new laws allow manufacturers to recover input VAT on all purchases, including services and fixed assets. This eliminates the previous “hidden cost” of non-recoverable VAT, directly improving cash flow and reducing the cost of production.

Zero-Rated Essential Goods: To stimulate demand and support social welfare, basic food items, medical supplies, and educational materials are now zero-rated. Manufacturers in these sectors can now claim full VAT refunds on their inputs while charging 0% to the end consumer, making locally produced goods more affordable.

Company Income Tax (CIT) Relief for Growth: Small and medium-scale manufacturers with an annual turnover of ₦100 million or less are now fully exempt from Company Income Tax. For larger firms, the roadmap includes a planned reduction of the corporate tax rate from 30% to 25%, bringing Nigeria’s rates in line with global competitive standards.

Introduction of the Economic Development Incentive (EDI): Replacing the older “pioneer status” holidays, the EDI offers a 5% annual tax credit for five years on qualifying capital expenditures. This encourages manufacturers to invest in modern machinery and advanced technology.

Elimination of Minimum Tax: The removal of the minimum tax requirement ensures that manufacturers are only taxed on actual profits earned, protecting businesses during periods of low productivity or economic downturns.

Simplified Compliance through E-Invoicing: The transition to a digital, automated e-invoicing system under the Nigeria Revenue Service (NRS) is expected to reduce the administrative burden on tax departments, allowing firms to focus more on core industrial operations.

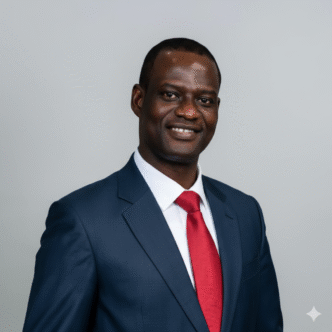

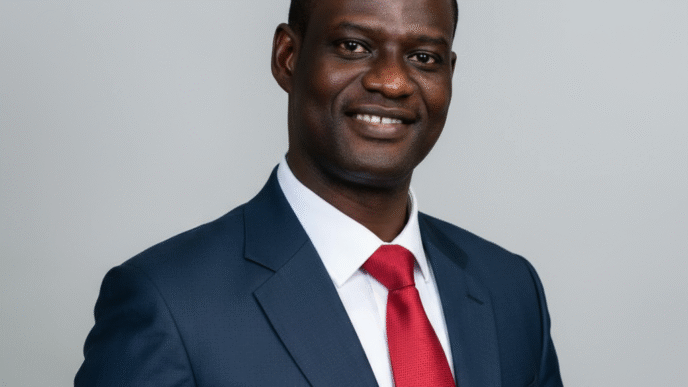

“The 2026 tax reforms represent a paradigm shift from ‘taxing investment’ to ‘taxing consumption and returns,'”. “By allowing for broader VAT recovery and introducing targeted credits for capital expenditure, the government is providing the manufacturing sector with the fiscal breathing room needed to scale, innovate, and compete on the continental stage.”

The Federal Government and the Nigeria Revenue Service (NRS) have committed to providing continuous administrative guidance and support to ensure a seamless transition for all industrial stakeholders.